Apple card belongs to Apple Ink. This is the first credit card that offered by Apple. It was issued by Goldman Sachs. This is something that refreshes Apple users with another facility for millions of Apple users. Apple card is designed for iPhone’s Wallet app and Apple pay. In earlier times, when users could not be able to pay digitally, then they required a physical card that made with titanium and written user name with laser-etched into its surface. Apple card is also something like that. But unlike other credit cards, it does not contain a card number or CVV code. It is just a simple card that represents simplicity, transparency, and privacy.

If you need to get information, then all those things stored in Apple wallet app. So if you have an Apple card, then you must have an iPhone, and it is essential. Because of the high security, millions of Apple users love this Apple Card and users have to pay less interest.

Brief in Apple card

Using the Apple card, it is easy to make digital Apple payments as well as a physical card. It is made of titanium, and it includes laser etched with the owner’s name. The Apple new credit card is from Goldman Sachs, and it works with Apple Pay and iPhone’s Wallet app. Here Apple card offers a higher average of cashback when using it through Apple Pay and no more penalties.

Apple Card – Unique features

Basically, Apple card is a simple and straightforward credit card. It includes many unique features, and before going to use it, you have to know about them.

This latest Apple facility, Apple card basically request the side support of Apple Pay and iPhone’s Wallet app. Using Apple Pay now you can pay for products and Apple Pay support for below devices.

- iPhone models with Face ID, Touch ID and except for iPhone 6 and above, as well as iPhone SE

- iPad Pro, iPad Air, iPad, and iPad mini models with Touch ID or Face ID.

- Apple Watch Series 1 and 2 and later.

- Mac models with Touch ID.

Now you can have the best rewards that you received using the Apple Card with Apple Pay.

- When making purchases by participating merchants, you can have 3% back

- For direct purchases, it made 3% back

- For other Apple Pay purchases 2% back

- If you use the Apple cars( physical titanium card ), you can get 1% back rather than Apple Pay

Not any more waiting, rewards are applied daily to Apple Wallet’s cash account. (it is better rather than waiting for 30 days for having rewards. Here users are allowed to use Apple cash to make purchases and Apple card balance)

They have an impressive Apple’s fee structure. It does not require an annual fee for Apple Card. These fees are entirely free, and when you log in to Apple card website, you can see all of them. It does not take fees nor hidden ones as well. That includes traditional credit cards fees, cash advance fees, and international purchase fees.

How to get Apple Card?

It is a straightforward procedure, and there is no hard process to follow. In fact, there is now an online application to fill the to get Apple card. To get this opportunity now, you can follow the below steps. Those are,

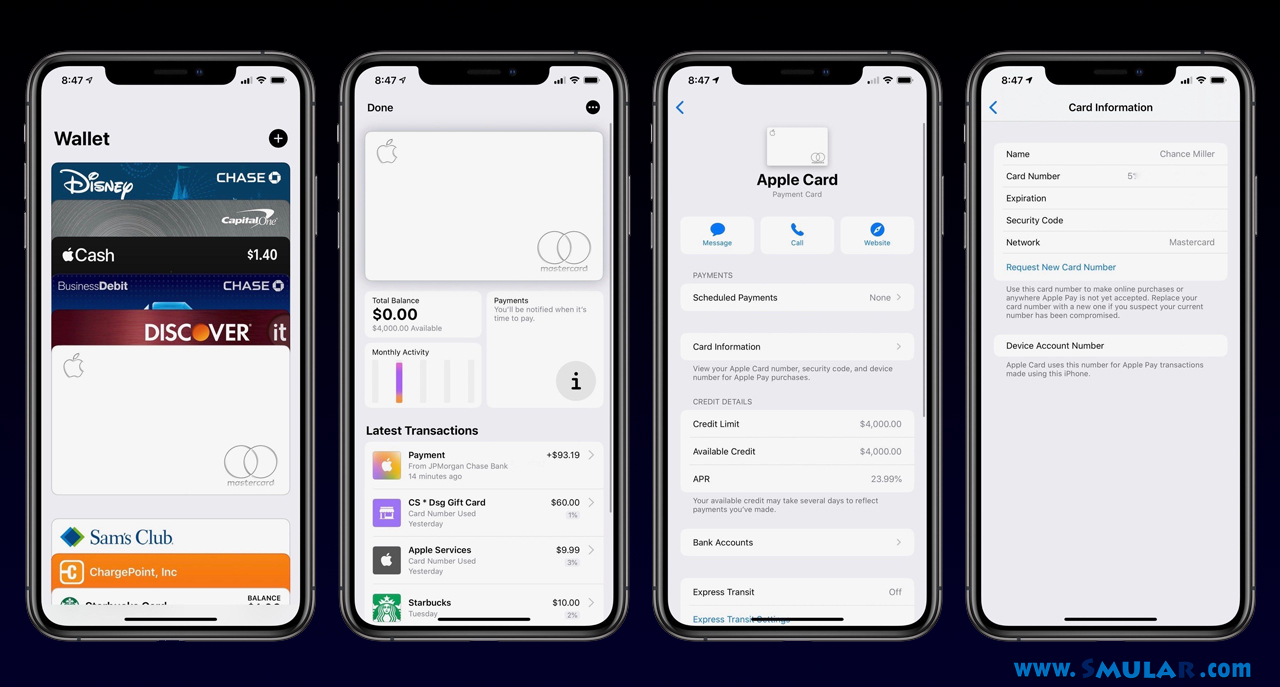

- Open Apple Wallet app on your iPhone

- Then tap on the “+” button in the upper right corner

- Select Apple card and then complete the form

Then the qualification process starts, and it takes only a few moments. Now you can use the card with your supported credit limit.

How does it work? Pay with your Apple Card

If you completed the above process, then you can get you Apple card. The now, how does it work? Basically, there are three ways that you can use the Apple card. Those are,

- Using the Wallet app and Apple Pay

- By swiping the physical card

- By giving your credit card number to the merchant

When you have completed the application process, then the Apple Card is automatically added to your Wallet app. So then you can do purchases using Apple Pay. When your Physical card arrives, it allows purchases by swiping the card in a point of sale terminal. This is not supported for contactless terminals. If the contactless purchases are there, then users have the best option, that is Apple Pay with your iPhone, iPad, iPod touch or Apple Watch instead.

To make a purchase, you need to have an Apple card number and CCV code. If you do this purchase using your iPhone, then Apple Card could able to generate a secure and virtual credit card number for all the non-Apple Pay purchases.

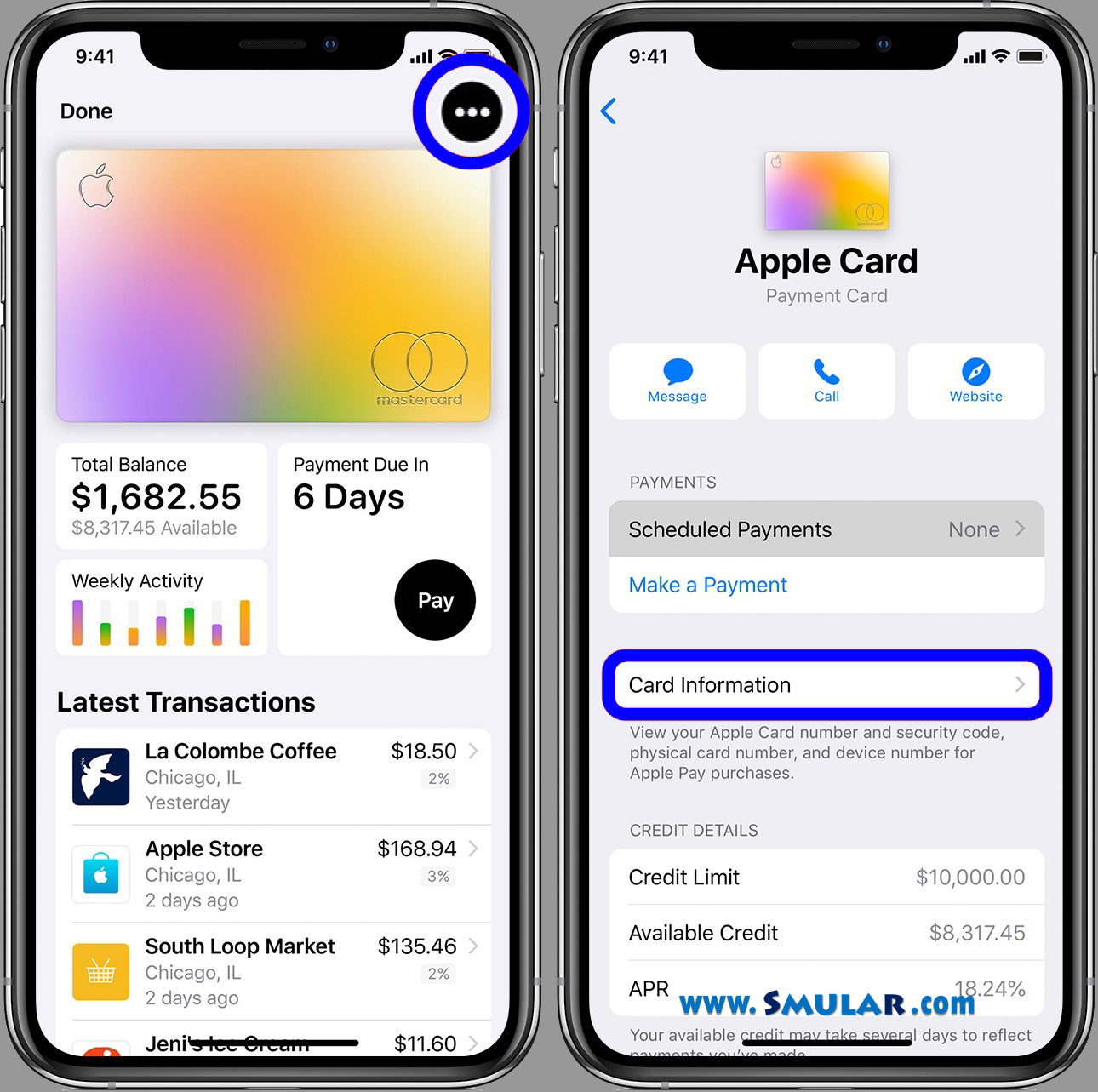

Now you can try below steps to find the number and CCV code.

- First, you have to open the Wallet app.

- Then select the Apple Card.

- Then tap on three dots in the upper right corner.

- Tap on “Card Information.”

Now you can see all the details that you are looking for. The card number, expiration date, and CCV code.

Here you can request a new card number by a tap on “Request New Card Number”. Then you can get a unique virtual card number without asking a new physical card from Apple.

However, this is easy, and Apple card means the newest Apple facility that gives Apple users to make their day to day life more flexible than ever.